Roth Conversion Ladder Bogleheads

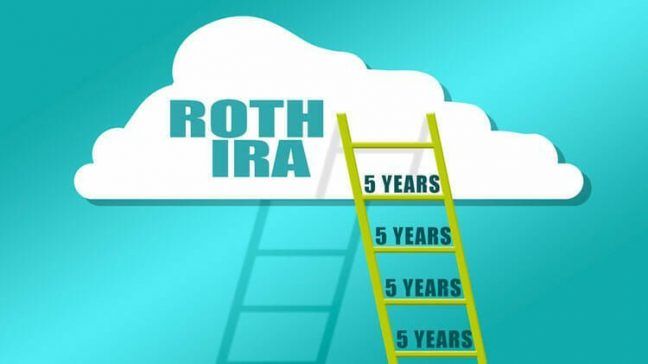

The roth ira conversion is a pretty obscure concept if you aren t changing jobs or planning to retire early.

Roth conversion ladder bogleheads. I m not sure why you would pay the tax on a tira conversion and withdraw from your roth. In return the money will grow tax free in the roth ira. You pay tax at the time of conversion from 401k to roth. Traditional versus roth refers to the common investment decision whether to use a traditional or roth account.

Ignoring other income a single person climbing the roth ira conversion ladder will pay 3 213 in federal income tax each year to keep the ladder going. Everyone should learn about the roth ira conversion ladder even if you are not quite ready to retire yet. If you cannot contribute to a roth ira because your income exceeds the income eligibility limit you can still choose to contribute indirectly through a two step process known informally as the backdoor roth. You pay taxes as if you withdrew the entire amount converted but without any penalty for early withdrawal.

If you have a traditional ira you can convert part or all of the account to a roth ira. The roth conversion ladder is a powerful way you can pull funds from your roth ira or 401 k without paying taxes. Roth ira conversions from a traditional ira to a roth ira require one to pay the tax due without an early withdrawal penalty on any previously untaxed traditional ira assets converted. Okay the 2 main points are.

The net effect of performing these two steps is equivalent to contributing to a roth ira. That s the tax due on a 34 800 ira conversion. It is a bit of pain but you really ought to compare your additional taxes on a roth conversion now to the taxes on the same amount you would pay when the amount is distributed in retirement if you left the funds in your tax deferred account no conversion case there have been several threads about this. Nonetheless it is a rare gift from the irs.

Fortunately there is a way to escape the tax burden upon using the money. There s not a limit of roth conversion to standard deduction. Normally these types of withdrawals come with at least a 10 tax penalty. We are converting just shy of 45k this year which far exceeds our standard deduction.

Roth ira conversion ladder. Once rolled over start the roth ira conversion ladder at year 50 for the amount 50k in conjunction of 50k in long term capital gains from taxable accounts which bring my income to 100k then after std deductions get to 76k agi which then allows me to pay zero taxes on the long term capital gains netting taxes of roughly 8700 in year 50 and keep doing that till 55. To do the backdoor roth you. Taxes on the roth ira conversion ladder.